NetSuite’s new 2018.1 release includes a wide array of enhanced features. In this blog, Senior Consultant Daniel Merekyan highlights three of his favorite enhancements.

Multi-Subsidiary Customer

Since my first days as a NetSuite user, I can’t think of a more in demand and highly anticipated enhancement request than the ability to share the Customer record across multiple subsidiaries in a OneWorld instance. The NetSuite gods listened and finally delivered Multi-Subsidiary Customer for their 2018.1 release.

My only peeve with this feature? Why not call it Shared Customer like its counterpart on the procurement side, Shared Vendor? Why not keep the nomenclature consistent throughout the software? If anyone has the answer to that one, please feel free to share. In the meantime, let's focus on the positives, because there are quite a few.

Prior to 2018.1, in order to define a Customer record that would transact with two subsidiaries (e.g. one in Canada and one in the U.S.), it required two different Customer records. For example, Customer “ABC123 CAN” under the Canadian subsidiary, and customer “ABC123 US” under the US subsidiary had to be created. Three immediate drawbacks:

- Data entry error: The possibility of human error when creating the two Customer records, either through the User Interface or via the CSV import (“ABC123 CAN” vs “AB123 US”)

- Duplicating records: Even if you create each record accurately, you are still adding to your customer record count. Instead there should be only one customer record regardless of the number or subsidiaries it is associated to.

- Time Consuming: It is impossible to get a quick 360-degree view of a customer and their transactions in one simple view. This becomes even more painful when certain users that have access only one subsidiary, and not all of them.

As of 2018.1, these pains are a thing of the past! From a single customer record, you now can view records such as balances, transactions, and unbilled orders for all the subsidiaries that the customer is associated to.

In addition, the Transactions subtab now shows transactions from all the subsidiaries that the customer is associated to. Previously, this sublist displayed transactions from only a single subsidiary.

OneWorld users who have spent years setting up hundreds of Customer records across multiple subsidiaries can breathe easy. NetSuite has created a practical Merge feature to ease the pain of merging multiple Customer records into a single Customer record. Let’s take our first example shall we: say we want to merge customer “ABC123 CAN” and “ABC123 US” under a unique Customer record. Open customer record “ABC123 CAN” in EDIT mode. You will see the Merge button at the top of the page. Once clicked, the user will be taken to the Merge Customer page. There you will choose which Customer record you want to Merge into. You can either choose record “ABC123 US” and then rename it to ABC123 after the merge or create ABC123 in a previous step and merge into it. A few things to consider at this point: this process is irreversible, so be sure this is what you want to do. Second, all the transactions from the child customer will now be linked to the record it is being merged into. Lastly, you will need full permission to the Customer record to be able to use this feature.

Here are a few more important notes about this great enhancement you want to be aware of:

- Intercompany Vendor/Customer behavior remains unchanged

- Multi-relationship/polymorph entity records are supported

- A Multi-Subsidiary Customer record can have a different set of subsidiaries than the related Vendor record. The primary subsidiary however, needs to be the same for both.

- You cannot define secondary subsidiaries through SuiteScript or CSV import

- Transactions supported: All Order to Cash transactions, All Procure to Pay transactions, Journals, Custom Transactions

Customers shared across subsidiaries is a long-awaited feature and finally here. This enhancement was a no-brainer and one that will be received with great anticipation throughout the NetSuite ecosystem!

Electronic Bank Payments

Let’s start from the top. The names. Gone are SuiteApps NetSuite Electronic Payments and NetSuite Electronic Payments for OneWorld. Enter Electronic Bank Payments and Advanced Electronic Bank Payments. Why the name change? We’re going to have ask NetSuite for that one. The rename did not happen in 2018, just a useful mention for those who haven’t used the functionality in some time.

The new SuiteApps follow the same structure as the predecessors the Electronic Bank Payment bundle is still available at no cost. It enables companies and their subsidiaries to send payments to vendors, employees, and customers (refunds) or receive payments from customers located within their country of operations. Again, much like its OneWorld predecessor, the Advanced Electronic Bank Payments has a cost attached to it. Users will require this bundle when looking to transact in a denomination that is different from their functional currency.

While the standard templates that come with the bundles cover the majority of bank payment file specifications, you will need the advanced version to be able to edit the templates. The free version templates come as-is and are non-modifiable.

In 2018, users who have a multilingual instance will now enjoy a fully translated Electronic Payments module. Previously this module would stick out like a sore thumb in English amidst all the other translated menus and navigation. To enjoy these new features users will have to make sure that Multi-Language and Advanced PDF are enabled. The feature now supports 22 languages and is applied to: screen elements, field level help, error messages, warnings, and email notifications.

Here’s a list:

Contextual help is now translated:

Error messages:

Acknowledgements:

One of the most important features to note is that templates coded in XML are now obsolete and no longer supported. Previously you couldn’t create new templates using XML, existing ones were still supported. But this is no longer the case: All the standard templates are coded in FreeMarker and new ones can only be created using the latter as well.

In addition, for a limited time, you will be able to generate an output in XML using the FreeMarker format if you require it. The only catch here is that you cannot use XML to code your template. There is no indication from NetSuite as to when this will no longer be supported.

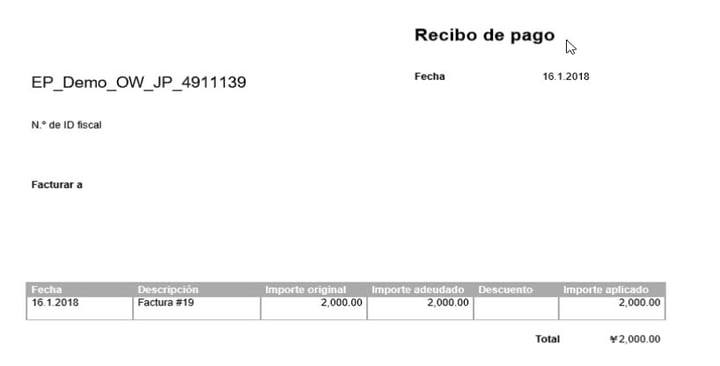

Finally, the feature will leverage the recent enhancements to the customer record with Multi-Subsidiary Customer. On the payment transaction screen, you will now be able to select the subsidiary of your choice for that customer. The subsidiary selection will filter the transactions available for that customer’s subsidiary.

Bank and Cash Management

In recent years, the NetSuite team has worked diligently at improving their native Reconciliation Process. If you remember, in 2017.2, the interface got an important facelift and allowed to match imported transactions with the transactions in NetSuite on the same screen side by side. Previously, this was accomplished using two different screens.

For 2018.1, NetSuite keeps the improvements coming with the introduction of the Account Reconciliation portlet. Any accounting team will welcome this new feature as it offers quick access to day-to-day reconciliation tasks directly from your home page.

In the last release, we saw the additions of BAI-2 and CAMT file formats added to the list of those accepted by the statement import feature. As of 2018.1, you can add CSV to the list of formats. Not only is this a popular format offered by numerous banks, existing NetSuite users are already very familiar with the CSV file format with data imports. NetSuite offers a link to the newly predefined template from the upload page.

And now for the “Piece de resistance”: enhancements to custom matching rules. NetSuite users will now have the ability to add custom matching rules at the account level. Previously, once a rule was created, it was applied to all accounts and considered global. Now, if you want to define certain rules for that pesky UK credit card account, you can have a rule or rules tailormade for that account. Another nice feature, is the ability to “inactivate” a rule rather than having to delete the rule altogether when no longer needed.

Finally, you will have more import transaction types to add increased granularity to your downloaded transactions.

As for new NetSuite transaction types to map to: you can now add credit card charges and refunds to the list.

Interested in learning about more of the updates for 2018.1?

Stay tuned for our next blog summarizing some of the other exciting enhancements in the latest NetSuite release!

Get Started Now

The easiest way to get started is to contact Techfino today. If you’d like a little more information first, you can download our ContinuedSuccess Whitepaper. Either way, we hope you’ve found this guide helpful and hope that we can further assist you on your path to leveling up your NetSuite Support.